Overview

Pesatech accelerator program invites applications from Fintech startups across all regions in Tanzania.

The program offers a comprehensive suite of resources designed

to cultivate the next generation of groundbreaking financial technology solutions.

While not every applicant may qualify for immediate participation in both funding and program elements, the program's true strength lies in its approach to fostering transformative ideas.

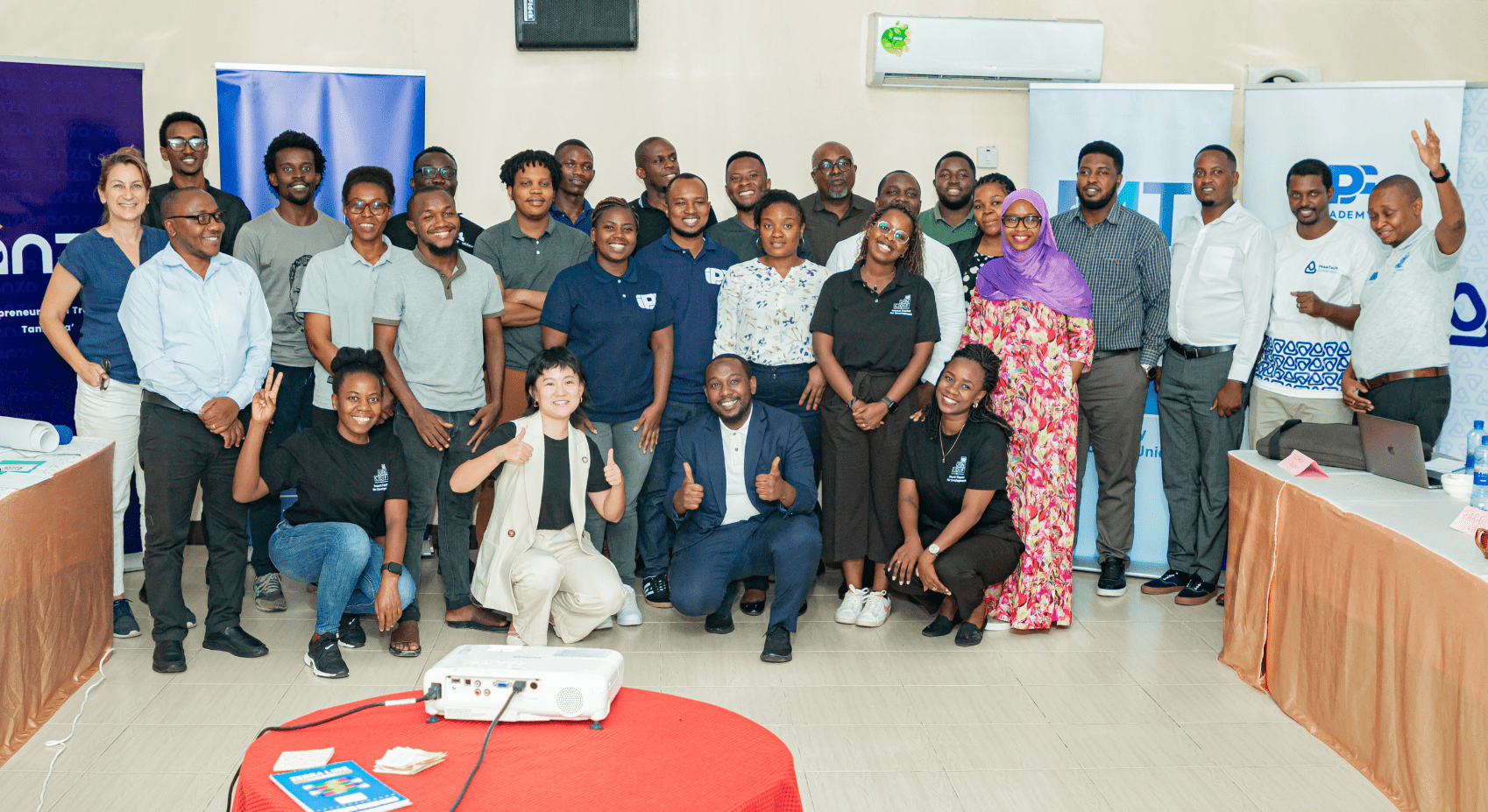

Technical Bootcamp For Startups By iPF Softwares

Technical Bootcamp For Startups By iPF SoftwaresThis year , there were two primary assessments conducted:

a business assessment to evaluate the business viability of the applicants' solutions conducted by our partner Anza Entrepreneurs and

a technical assessment performed by IPF Softwares to ensure that the solutions were market-ready.

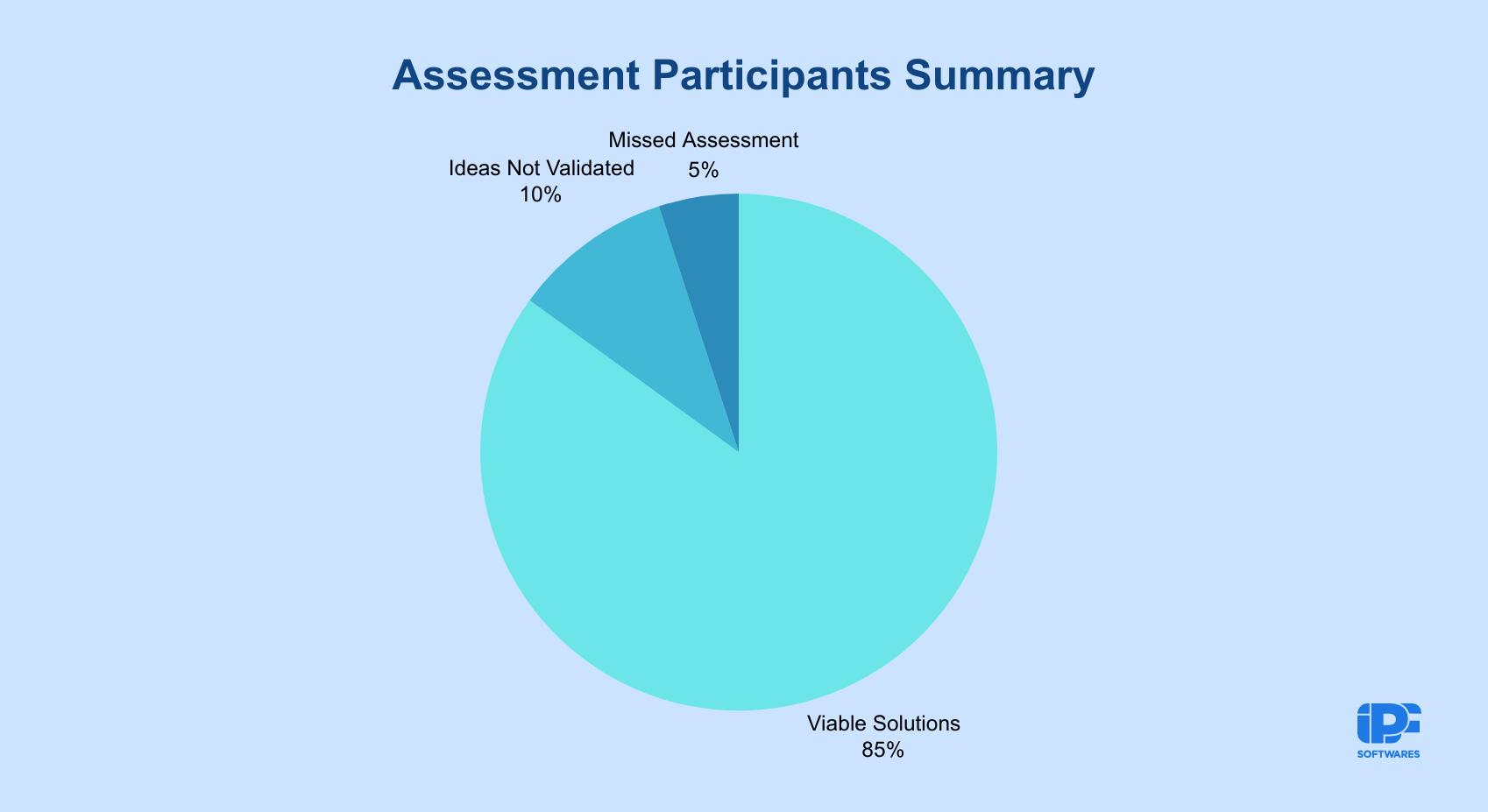

Some applicants did not have tangible solutions at the time of application, while others had solutions that were not well-organized and needed refinement.

The program aimed to identify startups that were either market-ready or stable and could benefit from the resources offered by the accelerator.

During the assessment process, the team looked at the technological state of the applicants' solutions to determine whether they could be helped by the program.

This included evaluating the state of the solution,the team, and its potential for improvement.

The goal was to ensure that the support provided would be meaningful and impactful, rather than a "drop in the ocean."

Fintech General Assessment Findings

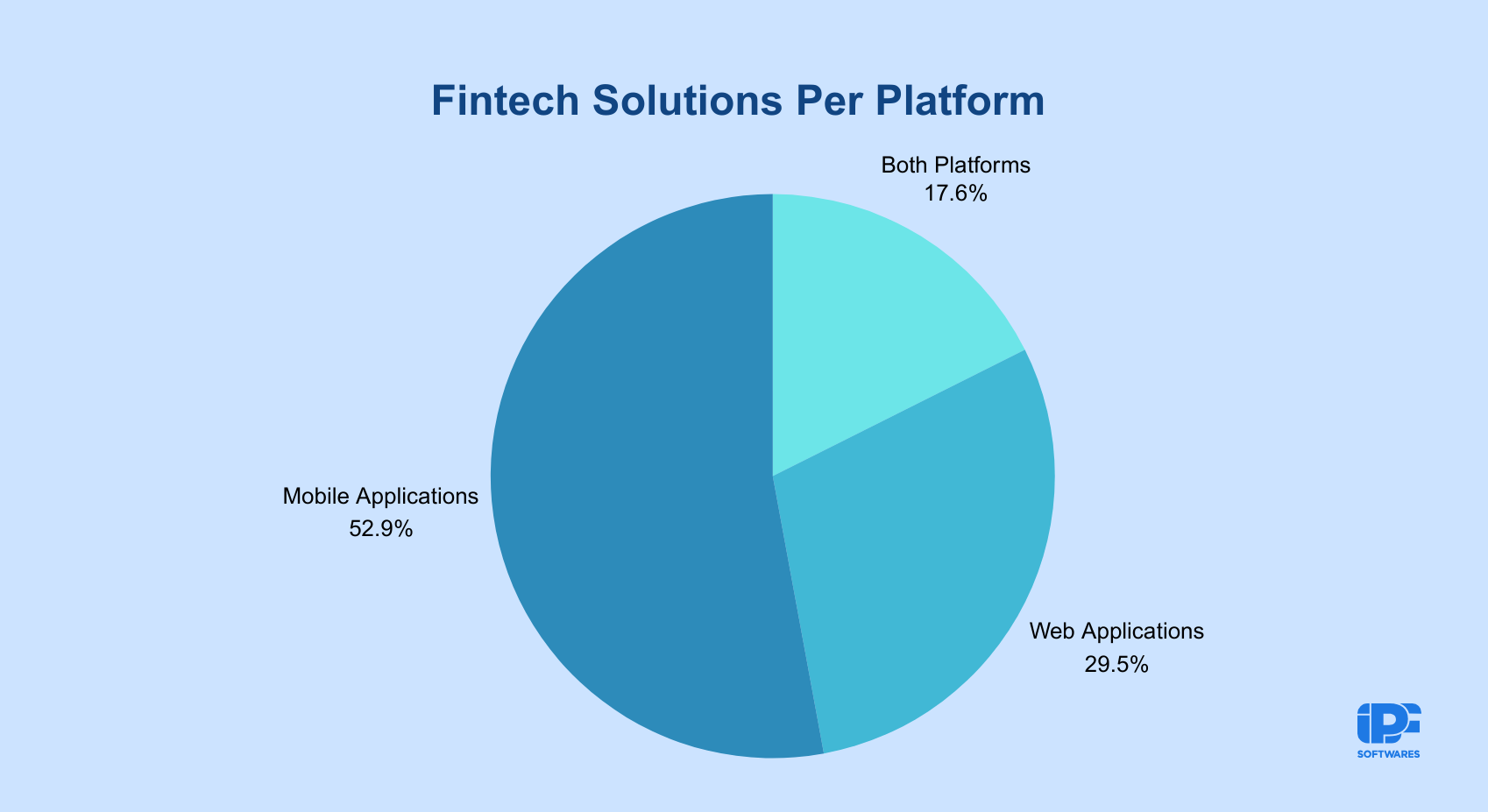

Fintech solutions Distribution By Platform

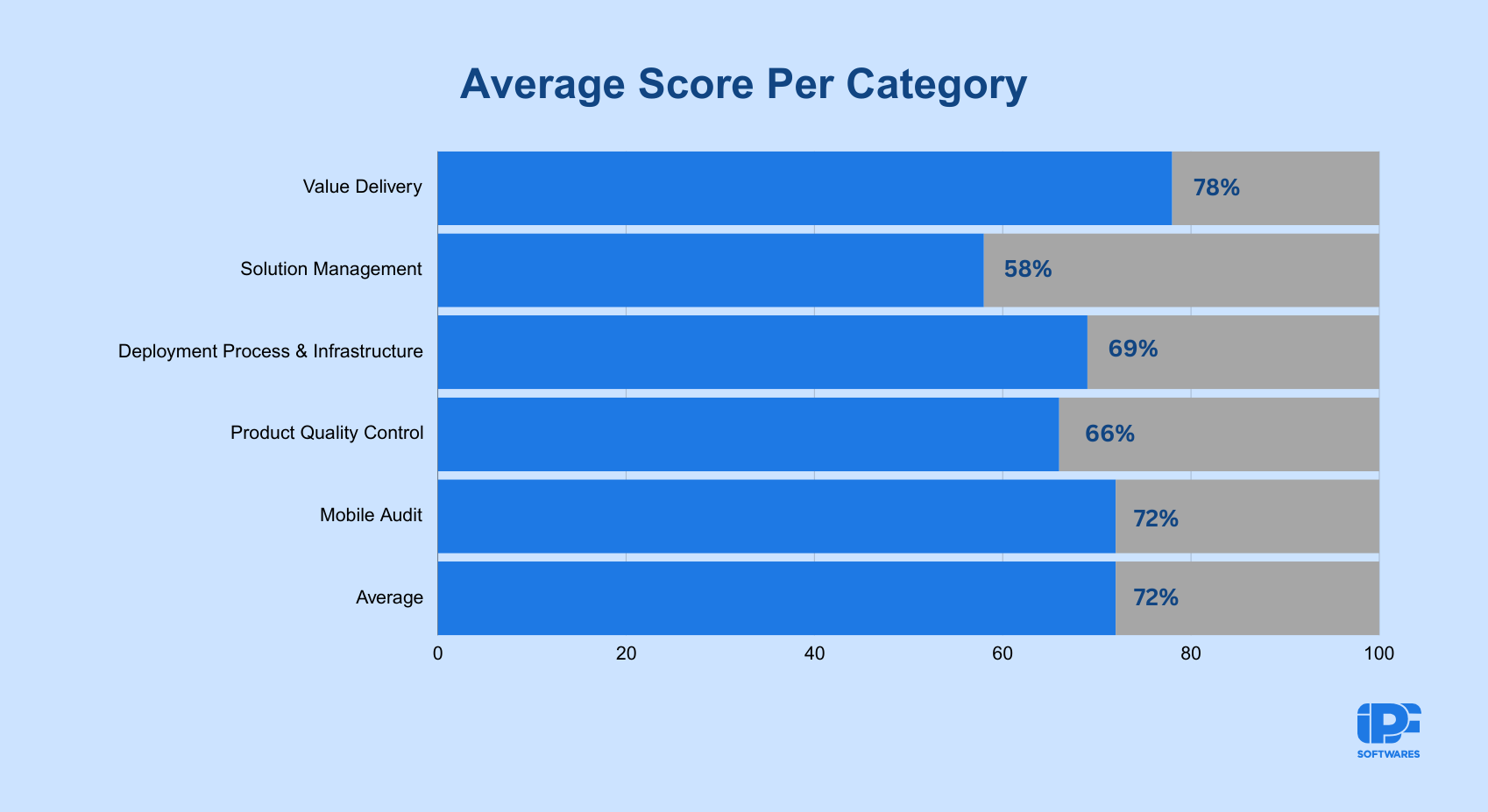

Fintech solutions Distribution By Platform Fintech Solutions Average Score Per Category

Fintech Solutions Average Score Per Category Assessment Participants Summary

Assessment Participants Summary- The startup ecosystem in Tanzania is still developing, with a limited number of startups that need significant support and development.

- Many startups lack market-ready solutions and require assistance to refine and organize their ideas.

- Many solutions prioritize functionality over user experience. A significant number of solutions exhibited below-average user interfaces.

- Several startup teams were observed to lack proper organizational structures.

- For Mobile-Based Solutions, there's an urgent need for applicants to embrace best practices and architecture patterns to build resilient, high-quality apps.

The Pesatech Accelerator

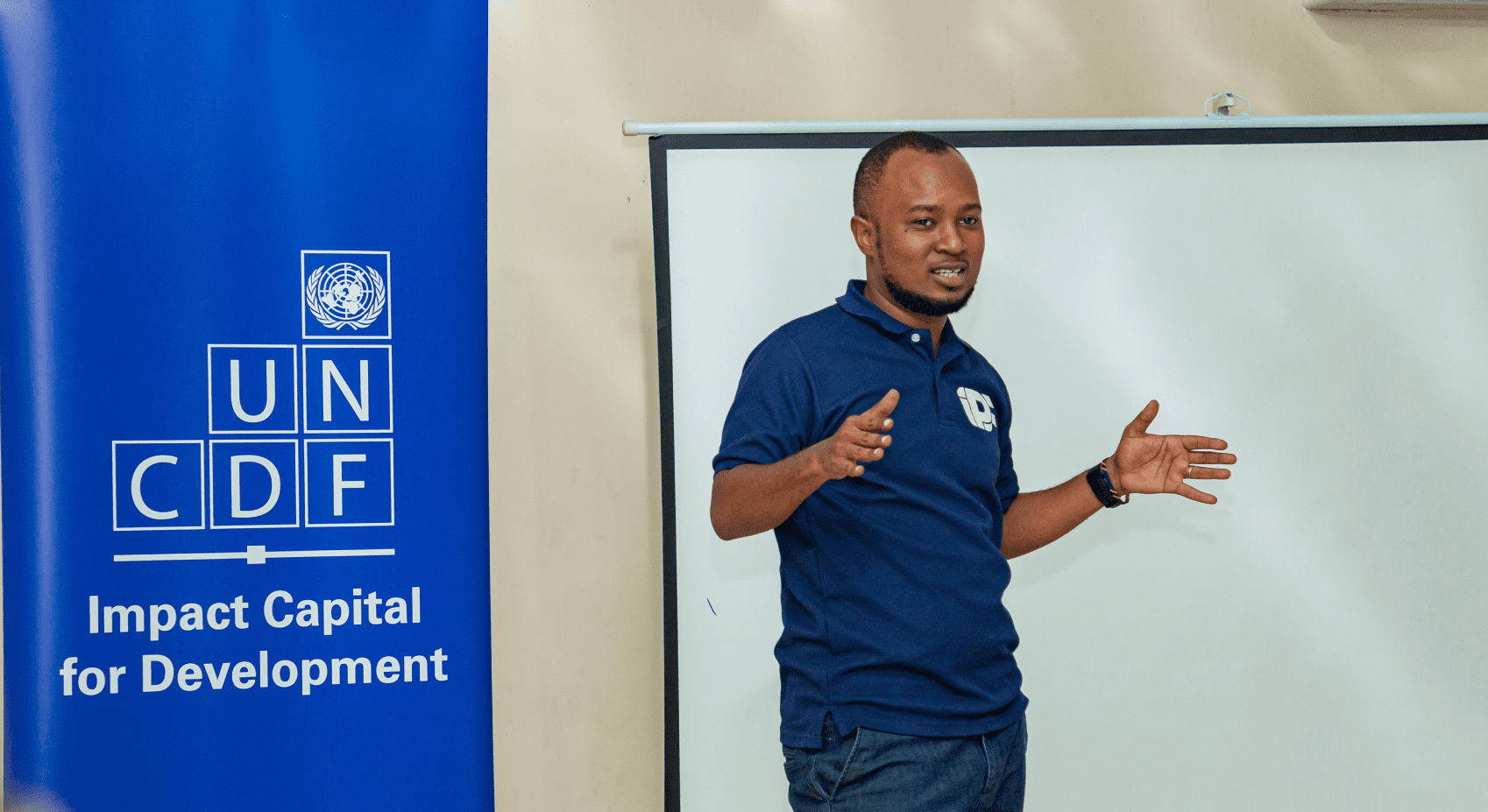

The Pesatech program is an accelerator focused on fintech solutions in Tanzania.

An initiative by UNCDF with the mission to empower and help fintech startups in Africa to build and scale their solutions.

The program started in 2022.

In the first cohort, UNCDF in partnership with Sahara Ventures, iPF Softwares and other partners facilitated the acceleration program for 20 startups, you can learn more about the previous cohort here

In 2023-2024,during the second cohort, UNCDF in partnership with NMB Bank, Anza Entrepreneurs, iPF Softwares and other partners.

So far we have audited and reviewed FinTech solutions from 40 startups.

During the process, we performed a technical audit and review of the startup solutions before they were accelerated.

After identifying the challenges and issues faced by these startups, we created a customized curriculum and program to train the teams and founders on how to upscale their solutions.

Compared to the assessment last there is a notable improvement in this year, reflecting the growth of the fintech space.

Many startups had solid solutions, with most of them being post-MVP and post-revenue.

.png) Pesatech Accelerator

Pesatech AcceleratorAssessment Process

Phases

First phase: Involved virtual interviews conducted via video calls, providing a convenient and flexible way for the interviewers to meet with the team remotely.

This initial phase aimed to gain an understanding of the solution and the team behind it.

Second phase: Was more hands-on, involving the actual testing of the solution.

Allowing our team of experts to verify the functionality and performance of the solution in a controlled environment, ensuring it meets the required standards and objectives.

Participants

The interview team included two key roles to cover both business and technical aspects of the solution.

A business representative provided crucial insights into the business problem the solution is designed to address, ensuring that the solution aligns with the company's goals.

Technical lead or senior member of a startup’s technical team : They were responsible for explaining the implementation details and technical functionalities,

ensuring that the interviewers understood how their solution works from a technical perspective.

Structure

The interviews were structured to be thorough and informative, scheduled for a two-hour session to allow ample time for detailed discussions.

The session begins with an initial presentation where the team provides an overview of their business and the specific solution they are presenting.

This includes a detailed explanation of the problem the solution aims to solve and how it operates.

Following this, the teams demonstrated the solution, showcasing its features and capabilities.

During this demonstration, the team explained the technology stack used and the architectural design, while the interviewers ask questions to probe deeper into the functionality and design of the solution.

Evaluation

During the interviews, the solution was evaluated on several critical aspects.

First, the alignment of the solution with the stated problem it designed to address.

Then identifying areas for improvement, providing constructive feedback on how the solution can be enhanced.

Technical Assessment

Technical AssessmentTechnical assessment criteria

After the initial interview phase, the process moved to the technical assessment phase,

The technical assessment follows these criteria

Solution reliability, usability, scalability, and Security.

Reliability

The technical assessment conducted evaluated the solution's underlying structure to evaluate its reliability.

This involved three key areas:

Codebase Review: This review examined the code itself, focusing on factors that contribute to a reliable system:

- Code Structure: Is the code well-organized, modular, and easy to understand?

- Coding Practices: Are established coding standards and best practices followed consistently?

- Error Handling: Does the code have robust mechanisms for handling errors and exceptions gracefully?

Technology Stack Evaluation: This evaluation assessed the chosen tools and frameworks from a reliability standpoint:

- Robustness: Do the chosen technologies have a proven record of stability and reliability in production environments?

- Scalability: Can the technologies handle the anticipated workload and user base without significant performance degradation as the system grows?

- Security: Do the technologies address potential security vulnerabilities and ensure data integrity?

Architectural Design Review: The system's architectural design was examined for potential weaknesses that could jeopardize reliability:

- Single Points of Failure: Does the architecture have any single points of failure, meaning a single component outage could bring down the entire system?

- Redundancy and Fault Tolerance: Are mechanisms in place to ensure the system remains operational even if individual components fail?

- Performance Optimization: Is the architecture designed for efficiency and scalability to handle peak loads without performance bottlenecks?

Usability

The solution's usability was evaluated through a comprehensive assessment of its User Experience (UX) and User Interface (UI) design. This evaluation ensured that the solution adhered to user-centric design principles, even in the absence of strict, pre-defined design guidelines.

The assessment focused on two key areas:

- Alignment with User-Centric Design Principles: Evaluators examined whether the design followed established best practices for usability. This included analyzing factors like:

- Information Architecture: Is the information presented in a clear and organized manner, making it easy for users to find what they need?

- Interaction Design: Are user interactions intuitive and consistent? Do they follow established patterns and conventions?

- Intuitive Use for Target Users: Evaluators went beyond design principles and directly tested the solution with the target user perspective, gathering feedback on:

- Ease of Use: Can users complete tasks quickly and efficiently without encountering difficulties?

- Intuitiveness: Is the solution inherently easy to understand and navigate, even for users with limited prior experience?

Scalability

Solutions were evaluated for their ability to adapt to future growth. This assessment focused on two key aspects: Infrastructure Management and DevOps.

Infrastructure Management examined how effectively the system's underlying infrastructure is designed and maintained. This included scrutinizing:

- Scalability: Can the infrastructure handle an increasing number of users or data without significant performance degradation?

- Resource Utilization: Are resources such as servers, storage, and networking efficiently allocated and used?

- Disaster Recovery: Does the infrastructure have built-in redundancy and backup mechanisms to ensure smooth operation in case of outages?

DevOps, on the other hand, assessed how efficiently the development and deployment processes are streamlined. This involved evaluating:

- Continuous Integration and Continuous Delivery (CI/CD): Is there a well-defined CI/CD pipeline that automates testing, build, and deployment processes, enabling faster and more frequent releases with fewer errors?

- Version Control: Is there a robust version control system in place to track code changes, facilitate collaboration, and enable rollbacks if necessary?

- Deployment Automation: Are deployments automated to minimize manual intervention and reduce the risk of errors?

State of Fintech Startups

.png) Value Delivery

Value DeliveryValue Delivery

A solid 78% of products out there are genuinely trying to solve real problems, which means they bring real value to users.

These products succeed because they understand what people need.

However, some startups still miss the mark. They don't quite understand what users want and are often based on hype or unrealistic ideas.

This means they don't connect well with the people they're meant for.

By focusing on the real financial problems people face on regular bases, startups can create products that everyone wants to use.

This understanding helps make products that really deliver value, ensuring they succeed in the market.

So value delivery was about checking whether the features and how the solution is implement really addresses the pain points stated by the product owners themselves.

It was more of checking whether the promises have all been been fulfilled. again, what value are delivering to this user.

.png) Solution Management

Solution ManagementSolution Management

Almost 58% of startups have a clear process for building their products.

This is a good start, but many teams still struggle with proper project management.

They don't fully understand how to use project management tools for communication and team management, which can cause problems.

Not knowing how to manage projects and teams well can hinder the success of a product in the market.

Without good project management, tasks can get missed, deadlines can slip, and the product might not meet users' needs.

When teams know how to manage their projects and work together efficiently, they are more likely to create successful products that users love.

Deployment Process and Infrastructure

Deployment Process and InfrastructureDeployment Process and Infrastructure

From the findings, 69% of startups have suitable deployment processes

and reliable infrastructure for their products.

This means they have systems in place to effectively launch and maintain their products, ensuring stability and performance.

However, some startups fall short in this area.

They lack proper deployment processes and have limited understanding of DevOps practices. This gap can hinder their ability to manage and scale their products efficiently.

Without strong infrastructure and deployment practices, these startups may struggle with issues like downtime, slow performance, and difficulty handling growth.

Investing in robust deployment processes and gaining a solid understanding of DevOps practices is essential.

It enables startups to build reliable, scalable products that can meet user demands and perform well under various conditions.

Product Quality Control

Product Quality ControlProduct Quality Control

An overall score of 66% for quality control is pretty good.

But it's important to have quality control practices throughout the entire development process, not just at the end.

Checking for quality from the start makes sure the product is good at every stage.

Doing this also helps avoid technical debt. This means fixing problems early on so they don't become bigger and more expensive to deal with later. It makes the development process smoother and the final product more stable.

Fintech products need to be valuable, reliable, and secure. Using quality control measures from the start helps build trust with users and makes sure the product works well in the market.

Mobile Audit

Mobile AuditMobile Audit

For mobile-based solutions, it's crucial for developers to follow best practices and use good architecture patterns to build strong, high-quality apps. Some practices that need to be adopted include

Following Good Architecture Patterns in order to keep the code organized and easy to manage. This makes the app easier to test and scale.

Optimizing the app for performance such that it uses minimal memory, saves battery, and loads quickly.

Putting more emphasis on User Experience (UX); design the app to be easy and pleasant to use.Incorporating feedback and making improvements based on what users need.

Conclusion

We are honored to contribute as technical auditors and advisors in this program, as well as provide training and mentorship to the startups within the ecosystem.

Our goal is to ensure that the solutions developed make a meaningful impact in the financial world through iPF Academy

Participants in the Pesatech program have recognized the value of the program and the training received from the IPF Academy, acknowledging how it has transformed their approach and capabilities.

This year, some of the startups involved in the program include Amala, Bizy Tech, Chapp/Kiasi, El-Dizer, HashTech, LindaPesa, MedPack, Shule Yetu Innovations, Simplitech, and Swahilies.

Here’s what they had to say:

Simplify VFD is a digital platform providing a seamless solution for businesses in Tanzania to issue tax EFD receipts directly from their phone. Our platform is accessible via a mobile app, web application, WhatsApp chatbot, or USSD shortcode, ensuring inclusivity for those without internet access. Being part of the second cohort of the PesaTech Accelerator in 2024 has been an invaluable experience. The workshops, bootcamps, and assessments provided by the Accelerator, particularly those run by IPF Softwares, have greatly enhanced our technical and operational knowledge. The technical bootcamp covered crucial aspects such as tech talent recruitment and retention, managing technical debt, and effective project management. The insights and shared experiences from the IPF team have enabled us to refine our technical operations, resulting in improved recruitment, smoother project management, and better team collaboration and communication. This has significantly increased our technical efficiency and added tremendous value to our fintech startup. We are proud and honored to be part of this transformative program.

At Amala, our vision is to enable all Africans to be financially included by automating the operations of financial institutions, particularly microfinance and SACCOS. We assist them in managing accounts, portfolios, loans, savings, and shares, allowing them to focus on their core business while we support their automation and compliance needs. Our participation in the PesaTech Accelerator was a transformative experience. The onboarding process was rigorous, involving technical and business assessments to ensure we were investment-ready. We were thrilled to be selected among the top 10 startups after the initial 20 were assessed. Through the program, we attended workshops focused on scaling our product, retaining key staff, and enhancing business practices crucial for growth. The workshops conducted by IPF Softwares and ANZA Entrepreneurs were particularly impactful. We learned valuable lessons on product interface improvements, cybersecurity, and quality assurance, thanks to IPF's comprehensive assessments. Implementing these insights has already started showing positive changes in our product.

MySafari, is a comprehensive booking platform that serves passengers, bus operators, and authorities, enhancing visibility and operational efficiency. This year, we were chosen for the PesaTech Accelerator program .The program provided us with technical and commercial skills. A memorable retreat in Bagamoyo with IPF Software taught us about scalable system development, which was invaluable for our tech understanding. Additionally, the commercial training with AnzaGrow helped us identify and address business challenges, market dynamics, and team-building strategies. Generally,The accelerator has significantly impacted our team, improving communication, KPI usage, and overall energy. It's also prepared us to be investor-ready. Personally, it has boosted our confidence and highlighted areas for professional and company growth. We're grateful for the program's ongoing impact.

For more insights on how to build scalable digital solutions contact us today.

iPF Academy offers expert guidance on how to create robust and scalable solutions. We're here to help you navigate the complexities of digital solution development.