We're excited to share our experience in assessing the quality of fintech solutions through the Pesa Tech Accelerator Program.

Pesa Tech Accelerator program, designed to support and accelerate the growth of early-stage fintech startups in Africa, provides participating startups with access to funding, mentorship, and resources to help them develop and scale their businesses.

As a leading technology company in Tanzania, iPF Softwares, partnered with UNCDF and Sahara Ventures, had the opportunity to conduct technical assessments for 18 fintech startups and facilitate a technical bootcamp to upskill startup founders and developers.

The assignment proved to be a challenging but rewarding experience, and through it, we gained valuable insights and knowledge that we will use to continue promoting innovation and expansion in technology in Tanzania.

In this case study, we will share key lessons, challenges, feedback, and recommendations for building successful fintech solutions or any other digital solutions.

Collection of Pesa Tech Accellerator Bootcamp Pictures

Collection of Pesa Tech Accellerator Bootcamp Pictures Key Takeaways from Our Experience in the Pesa Tech Accelerator Program

It was a challenging but rewarding experience, and we learned a lot along the way. Here are some of the key takeaways from our time in the accelerator program:

The importance of a strong team and partnership : Working on a project of this scale required a lot of collaboration, and we were fortunate to have a talented and dedicated team from UNCDF, Sahara Ventures and other partners everyone pulled together to ensure that all planned activities were completed on time and to a high standard.

The value of diverse perspectives: Each of the 18 startups we worked with had their own unique business model and technology stack, which meant that we had to constantly adapt and approach problems from different angles. This diversity of thought was crucial in helping us come up with creative solutions and identify potential issues.

The importance of continuous learning: The technology industry is constantly evolving, and it was clear that staying up-to-date on new technologies and trends was crucial to our success in the program. We made a concerted effort to stay informed and seek out new learning opportunities, which ultimately helped us to better serve the startups we worked with.

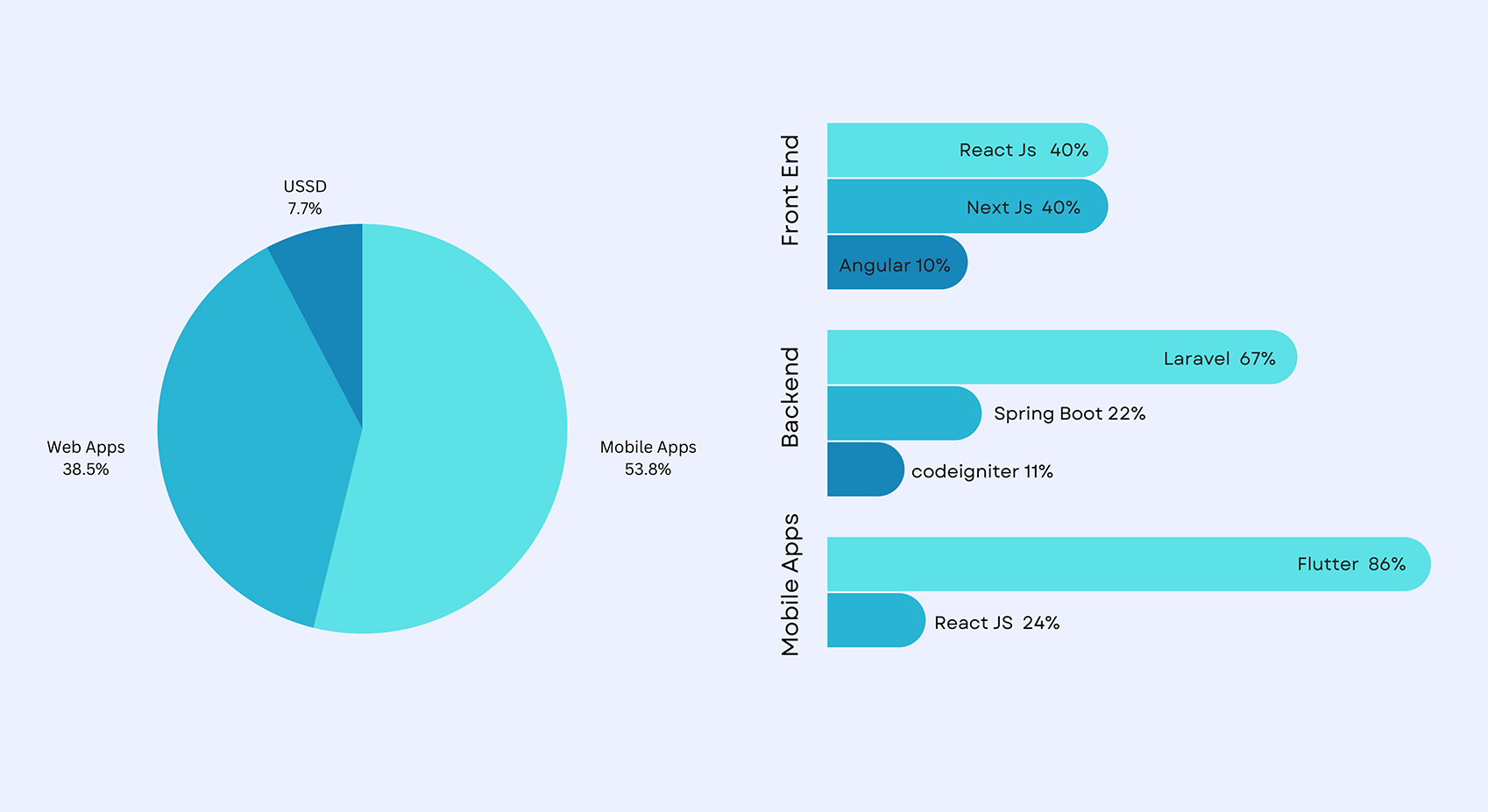

Pesa Tech Startup Solutions Stacks | Extract from iPF Softwares Report

Pesa Tech Startup Solutions Stacks | Extract from iPF Softwares Report Assessment Criteria Used To Audit 18 Fin-tech Startups

One of the key aspects of our role in the Pesa Tech Accelerator program was conducting technical assessments of the 18 startups.

In order to ensure that our assessments were comprehensive and fair, we developed a set of criteria that we used to evaluate the companies.

The criteria we used were grouped based on solution reliability, usability, scalability, and vulnerability.

Criteria 1: Startup Digital Solutions Reliability Testing

The objective in this assessment criteria was to ensure the technology solutions proposed by the startups were reliable and could be relied upon to function as intended, even under adverse conditions.

We review the following areas for reliability testing.

Conformance to requirements: Are the solutions built conformant to the promise stated?

Through User Acceptance Testing, the startup's solutions were evaluated to see if they satisfied the requirements and provided the promised value proposition (UAT). Our business analyst and quality assurance team carried out the UAT, concentrating on the chosen core features of the product.

Deployment Processes: Does the startup have the deployment processes in place and are they reliable?

The objective of reviewing the startups' solution deployment process was to ensure its efficiency and reliability. Our DevOps team at iPF Softwares evaluated if their processes were streamlined and included proper automation,testing and configuration.

The review involved checking if the startups had a configured staging environment for testing new features, and if they had set up Continuous Integration and Deployment (CI/CD) configuration in their deployment environments.

Software product Quality Control: How does the startup ensure the product quality is maintained?

As part of the deployment process review, the presence of tools for regression testing was also assessed. Additionally, the standard operating procedure for addressing bugs and issues encountered by end-users in the production environment was evaluated.

This was done to ensure that the startups had adequate measures in place to handle any issues that may arise during the deployment process and that their solutions were running smoothly and efficiently in the production environment.

Criteria 2: StartUp Digital Solutions Vulnerability Testing

iPF Softwares security expert conducted StartUp Digital Solutions Vulnerability Testing by performing various security assessments and tests on the startups' digital solutions.

This included testing for common vulnerabilities such as SQL injection, cross-site scripting (XSS), cross-site request forgery (CSRF), and others.

The testing was carried out either manually by a team of security experts or by using automated vulnerability assessment tools. In addition, penetration testing and simulation of real-world attacks were also conducted to identify and address any security weaknesses.

The objective of this testing was to identify and address any potential security threats or vulnerabilities in the startups' digital solutions and to enhance their overall security posture.

Criteria 3: Startups Digital Solution Quantitative Usability Testing

During the assessment by iPF Softwares’ UX team, Usability Testing was conducted to evaluate the startups' digital solutions by testing them with representative users. Our UX team carried out two main types of Usability Testing: Qualitative and Quantitative.

Qualitative Usability Testing was focused on collecting insights and findings about how people use the digital solutions. On the other hand, Quantitative Usability Testing was focused on discovering problems in the user experience.

The objective of Usability Testing was to identify and address any issues in the user experience and to improve the overall usability and user-friendliness of the startups' digital solutions.

Criteria 4:Scalability Assessment: Performance Optimization and Deployment Infrastructure

The scalability testing process was a crucial aspect of the assessment conducted by the iPF Softwares DevOps team.

This non-functional software testing methodology evaluated the performance of the digital solutions under increased or decreased workload.

The technology stack used to build the solution was also evaluated by our senior engineers to determine if it was optimized for scalability.

The deployment infrastructure was also assessed to see if it could accommodate the growing number of users and workload.

Finally, stress testing was performed to determine the software's performance under maximum workload conditions.

All these assessments aimed to ensure that the digital solutions were scalable, performant, and equipped to handle future growth.

By evaluating the startups against these criteria, we were able to provide a comprehensive assessment of the technical aspects of their solutions and offer recommendations for improvement where needed.

Key Feedback and Recommendations for Fintech Startups: Insights from the Pesa Tech Accelerator Program

Once we had completed the technical assessments of the 18 startups, we shared reports with each company outlining the key areas where their solutions could be improved.

These reports were designed to provide actionable recommendations and help the startups to identify areas for development and optimization.

We believe that this feedback was valuable for the startups, as it gave them a clearer understanding of their strengths and weaknesses and provided guidance on how to enhance their solutions.

We were happy to be able to offer our expertise and support in this way, and we hope that the startups found the reports helpful as they continue to grow and develop their businesses.

User Experience Recommendations: Enhancing the End-User Journey

During our assessment, we observed that one of the startups had implemented a confusing navigation system that made it difficult for users to find the information they needed. This resulted in a poor user experience and frustrated users.

To improve this, we recommended that the startup simplify their navigation structure, making it easier for users to find the information they needed quickly and easily.

For example, instead of having multiple levels of menus, the startup could use clear and concise headings and subheadings to guide users to the information they are looking for.

Additionally, they could also include a search bar to allow users to quickly find specific information.

By making these changes, the startup would be able to improve their user experience and provide a better overall product for their customers.

Security Improvements for FinTech Startups

In the security assessment of the startups, several areas were identified as needing improvement.

These areas included weak password policies, limited use of encryption, and insufficient authentication protocols.

To ensure the protection of user data, it was recommended that the startups take steps to address these issues and meet industry standards.

Some of the suggestions for improvement included implementing stronger password policies, increasing the use of encryption, and strengthening authentication protocols.

By taking these measures, fin-tech startups can provide a secure and trustworthy environment for their users.

Scalability Optimization for Fin-Tech Solutions:

Scalability is a crucial aspect of fin-tech solutions, as it determines their ability to handle increased workloads and user demands.

Our assessment team at iPF Softwares identified potential areas for improvement in this regard, and provided recommendations to the startups.

These recommendations included optimizing database design, improving code efficiency, and implementing caching strategies to ensure that the solutions can scale effectively and efficiently.

By making these changes, the startups could ensure that their fin-tech solutions are able to meet the growing demands of users without experiencing any performance issues.

DevOps Best Practices for Fin-Tech Startups

To ensure the stability, security, and scalability of their fin-tech solutions, startups must adopt DevOps best practices in the development of their solutions.

During the assessment by iPF Softwares, we emphasized the importance of continuous integration and continuous delivery (CI/CD) practices to streamline the development and deployment process.

These DevOps practices help fin-tech startups to better manage their digital solutions and meet the needs of their users.

Ensuring Data Protection through Database Backup

As part of our recommendations for improving the fin-tech solution, iPF Softwares emphasized the importance of setting up automatic backups for their databases.

This is a crucial step in ensuring the protection of user data in the event of a disaster. By implementing regular, automated backups, they can be confident that their valuable data is safe and secure, even in the face of unexpected events such as hardware failures, power outages, or cyber attacks.

By following our recommendation, they can provide peace of mind to their users and minimize the risk of data loss.

Importance of Documenting Technical Processes

Assessment conducted by our team at iPF Softwares, emphasized the importance of proper technical process documentation for fintech startups.

To ensure the smooth functioning of a fintech solution, it is crucial to have a clear understanding of the technical processes involved.

For most tech startups, it may not be feasible to maintain a full-time development team, and they may opt to work with freelancers in the early stages to manage their operating costs.

However, to ensure that these processes are done correctly, it is recommended that the founders encourage the developers to document their code, architecture, and deployment procedures.

These documentation can help the team have a comprehensive understanding of the solution and effectively maintain it over time.

Finally, we emphasized the importance of testing and conducting user acceptance testing (UAT) before deploying their solutions. This can help to identify any potential issues or bugs before they reach users, which can save time and resources in the long run.

By following these recommendations, we believe that the startups will be well-equipped to build and maintain high-quality, reliable fin-tech solutions that meet the needs of their users.

Technical Bootcamp in Bagamoyo: Empowering Fintech Startups with the Tools They Need to Succeed

After the technical assessments were completed, the PesaTech team organized a technical bootcamp to help the startups further improve their solutions.

iPF Softwares, led the bootcamp and provided training to the developers and non-technical founders working on the startups' solutions.

The bootcamp was a 5-day intensive program that focused on equipping the non-technical founders with the knowledge and skills they needed to better manage their development teams and product development.

Non-Tech Founders Training | Pesa Tech Bagamoyo Bootcamp

Non-Tech Founders Training | Pesa Tech Bagamoyo BootcampDuring the technical bootcamp in Bagamoyo, we had the opportunity to provide training to the non-technical founders on a variety of topics related to software development.

Introduction to Agile and Scrum for Non-Technical Founders

To support non-technical founders in their role overseeing software development projects, we covered the software development life cycle and introduced them to popular development methodologies.

The focus was on the Agile and Scrum framework, which are widely used for managing software projects. By understanding these methodologies, non-technical founders can gain a better understanding of the development process and support their development teams more effectively.

Developing Essential Skills for High-Quality Fin-Tech Solutions

The training program aimed to equip developers with the necessary skills to build and maintain high-quality fin-tech solutions that meet the needs of end-users.

The program was led by a DevOps engineer who trained the developers on the fundamentals of DevOps and provided practical exercises for hands-on learning.

Additionally, a senior frontend engineer from iPF Softwares was brought in to train the developers on UX design, which is a critical aspect of software development that focuses on creating user-friendly, accessible, and aesthetically pleasing digital products.

Through this training, the developers gained expertise in DevOps and UX design, enabling them to deliver efficient and effective solutions that meet the needs and expectations of end-users.

Overall, the technical bootcamp was a valuable opportunity for the startups to learn and grow, and we were grateful for the opportunity to share our expertise and experience with them.

We believe that the skills and knowledge they gained will help them to build and maintain successful fin-tech solutions that make a real difference in the world.

Our experience participating in the Pesa Tech Accelerator program as partners with UNCDF and Sahara Ventures was incredibly rewarding and helped us to grow both personally and professionally.

We are grateful for the opportunity to work with such innovative and forward-thinking organizations, and we are thankful for the support.

We would also like to extend a heartfelt thank you to the 18 startups who participated in the technical assessments. It was a pleasure to work with such talented and ambitious teams, and we are grateful for the opportunity to share our expertise and experience with them.

We believe that the skills and knowledge they gained during the program will help them to build and maintain successful fin-tech solutions that make a real difference in the world.

Thank you all for a truly memorable and enriching experience.

Success Stories: Startup Founders Share their Experience with the Pesa Tech Accelerator's Technical Assessment and Bootcamp by iPF Softwares

Discover the inspiring journeys of startups who have participated in the Pesa Tech Accelerator's Technical Assessment and Bootcamp by iPF Softwares.

Startup founders and developers share tangible results they've achieved for their businesses and the priceless knowledge they gained from working with iPF Softwares, UNCDF, Sahara Venture and partners.

These testimonials serve as testament to the program's effectiveness in guiding startups towards success. For more info on the technical assessment of Fin-Tech Solutions Contact Us.

I have to say that it was an experience that was highly beneficial for non-technical founders like myself. The sessions were incredibly informative, practical, and aimed at helping us create a productive working environment for both founders and developers. One of the key highlights of the bootcamp for me was the introduction of Scrum Framework to manage agile, which will be extremely useful in managing and tracking the development of our products. Overall, I highly recommend this bootcamp to any non-technical founder looking to understand the basic ways of running a tech business. iPF software's expertise and experience in this field is truly unparalleled.

I would like to express my gratitude to Pesatech Accelerator Team, UNCDF, Sahara Ventures, and iPF Softwares for the valuable skills and knowledge they imparted to Nderemo (Remmo Pledges) during the acceleration program. The technical bootcamp conducted by iPF Softwares experts was incredibly enlightening and added significant value to our product. We look forward to reaping the benefits of what we've learned and expect even more positive outcomes in the future. Thank you all for your support and guidance.

My experience with the Pesa Tech accelerator program and the technical assessment done by iPF Softwares was truly eye-opening. Before this program, with my team we were struggling to understand the overall health of our platform, JembePesa, which is a part of the larger Kilimo Maendeleo Digital Platform(KM 360) The assessment was thorough and identified areas for improvement in the platform. iPF Softwares provided expert advice and recommendations on technology usage and new solutions. The assessment was conducted using criteria including reliability, usability, vulnerability, and scalability. Although our team scored 66% overall, specific recommendations were provided to improve in each area. iPF Softwares also advised on important business practices, such as standard operating procedures and data analysis. The team is grateful for the experience and eager to implement the recommendations received.

iPF Softwares transformed me from a non-tech person to a tech expert through a three-day "non-tech workshop" in Bagamoyo in December 2022. The team made complex processes and frameworks easy to understand through simple analogies and examples, which helped me to manage staff time more efficiently, eliminate time wasted due to poor processes, increase our profit and improve our client relationships. I am now enrolled in an 8-week tech program, inspired by the transformation and no longer intimidated by technology. I want to express my gratitude to the iPF Softwares team for their support on a personal and company level. They are truly transformationalists and a blessing to us at EvMak Tanzania.